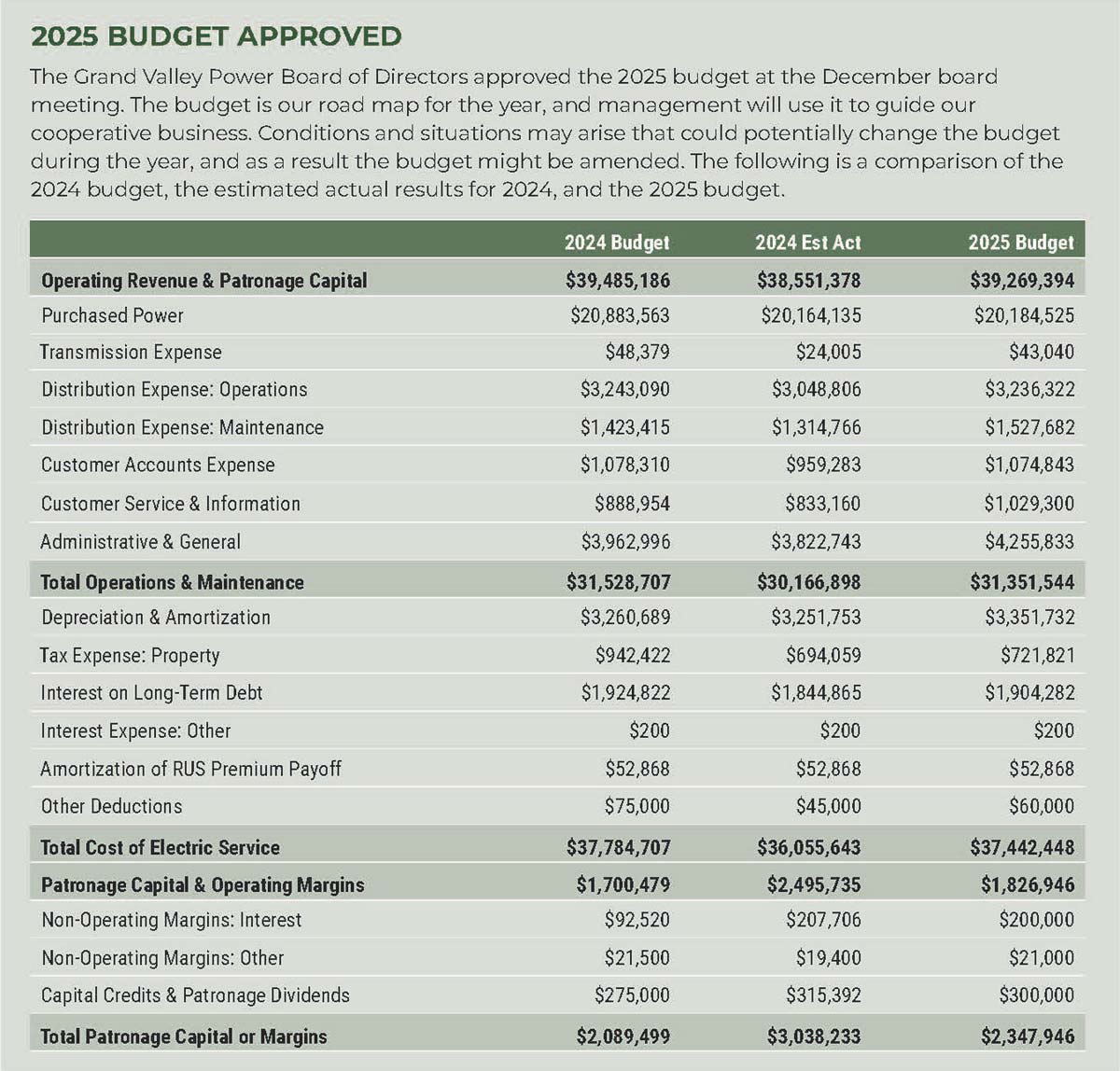

Budgeting for a Healthy Bottom Line

by Joseph Michalewicz, Chief Financial Officer

GRAND JUNCTION, COLO. - (February 4, 2025) Staying true to our mission — Empowering Lives with Hometown Service — is one of the most rewarding aspects of working for Grand Valley Power. With our members top of mind, we operate our cooperative at cost.

This is much different than most businesses our size, which are focused on making a profit. Without pressure to make a profit, we can focus on hometown service. We carefully balance expenses and revenue with the goal of providing safe and reliable power.

We raise rates only when necessary to ensure the integrity of our system operations and maintain financial obligations.

For GVP, maintaining the cooperative’s financial health is not just about covering operating expenses; it’s about ensuring long-term viability of our organization for our members today and the members of tomorrow. A solid, detailed budget serves as the cooperative’s financial roadmap, helping to guide board and management decisions that support both short-term needs and long-term financial health. Whether we’re navigating fluctuating power costs or investing in infrastructure, the budget keeps GVP on track towards fiscal health.

In today's economy, however, the budgeting process is challenging. In recent years, Grand Valley Power has tackled price increases for materials, services, power costs, and interest on loans. These increases affect the balance of revenue and expenses. Still, with a robust budgeting process, we continue providing GVP members with safe and reliable power while controlling costs.

UNDERSTANDING REVENUE REQUIREMENTS

The foundation of a successful budget is understanding revenue. As the number of meters that Grand Valley Power serves increases with new subdivisions and residential construction, so too does revenue. But other factors offset this revenue growth. Under our current rate structure, we rely on kilowatt-hour sales to recover some of the revenue we need to pay fixed costs.

When a significant number of consumers install distributed generation systems — better known as solar panels — our kWh sales drop. To accurately forecast revenue within the budget, GVP analyzes growth trends, energy use patterns, and rates.

Every few years, GVP also conducts a detailed cost of service study in collaboration with an independent firm. This analysis helps us to understand the revenue needed to provide exceptional hometown service and maintain the reliability of our cooperative’s distribution system. In this way, the cooperative can ensure that it has the revenue to cover anticipated expenses, plan for growth, and handle the unexpected.

PRIORITIZING OPERATIONAL EXCELLENCE

Grand Valley Power has both fixed and variable costs that it prioritizes within the budget. On the fixed side are taxes, depreciation, and interest on long-term loans, while two of Grand Valley Power’s largest expenses — the cost of purchased power and operations and maintenance — vary year to year. Prioritizing these expenses is key to staying within budget and providing exceptional service.

- Cost of Purchased Power: Grand Valley Power’s largest operational cost is electricity. As a distribution co-op, we buy electricity from a generation source and pay to wheel it across transmission lines to our service territory. Our cost of purchased power is approximately 52.5% of total revenue. This fact was the impetus for the board’s decision to explore alternative power supply options. The switch to Guzman Energy in 2028 will help control our cost of purchased power. Managing power costs effectively is sure to have a huge impact on the bottom line.

- Operations and Maintenance: Budgeting for routine maintenance and upgrades to aging infrastructure ensures that our cooperative can meet demand without compromising quality of service. Replacing old bucket trucks and transformers and strategically investing in infrastructure upgrades helps avoid costly repairs and unplanned outages. Over the past few years, high-priced necessities such as bucket trucks, power poles, transformers, and meters have increased as much as 50% in cost. Our operations staff closely monitors this budget with a goal of delivering on reliability and safety.

BUILDING ON RELIABILITY

Investing in the future is just as important as managing day-to-day costs. Much like replacing an old roof on a house, GVP outlines significant projects necessary to improve our system and grow the cooperative infrastructure to meet future demand. Recent considerations include upgrading power lines, expanding substations, and integrating smart grid technologies to assist in wildfire prevention.

Grand Valley Power maintains a construction work plan that provides the long-term perspective necessary to strategically allocate resources and prioritize projects that will have the greatest impact on reliability and safety.

While some projects are funded by margins, cooperatives also seek loans, grants, or other financing options that allow those costs to be spread over the asset’s life.

A HEALTHY BOTTOM LINE

A thoughtful and flexible budget helps us maintain our resources, invest in infrastructure, and meet both current and future needs. While Grand Valley Power cannot control external cost increases, we focus on what we can while considering larger expenses like purchased power. With careful planning, strategic investments, and ongoing communication with members, we can ensure financial stability for the cooperative and provide reliable power and hometown service to our members.