Grand Valley Power and its consumers will be hit hard financially due to Xcel Energy's imposition of outrageously high fuel cost adjustment charges for February 2021. Learn more about these Xcel FCA charges below:

Xcel Fuel Costs At-A-Glance

Xcel FCA Pass Through - Frequently Asked Questions

Winter Storm Uri blanketed the central United States with record cold temperatures in mid-February. The storm triggered a tightening of the market for natural gas, which is relied upon by energy providers like Xcel to heat homes and generate electricity. The price of natural gas shot up to unprecedented high levels, often hundreds of times greater than normal. Xcel and other providers were not prepared and ended up paying exorbitant prices for the fuel necessary to operate their generation facilities during times when demand for power was at its highest. Since Xcel is Grand Valley Power’s wholesale power provider, our consumers will be impacted by these high fuel costs.

While many members think of us as “the power company”, we in fact are an electric distribution cooperative. Grand Valley Power purchases almost all of its power requirements from Xcel Energy, our wholesale power supplier. Historically, the production of electricity is much more efficient and affordable when it is done on a large scale. For this reason, the electricity consumed by most Coloradans is generated by one of the big utilities like Xcel Energy, Tri-State, or Black Hills Energy. In our case, Xcel generates electricity at various locations across the state and delivers it to substations located in our service territory. GVP then transports the electricity across our distribution lines and delivers it to our consumers’ homes and businesses.

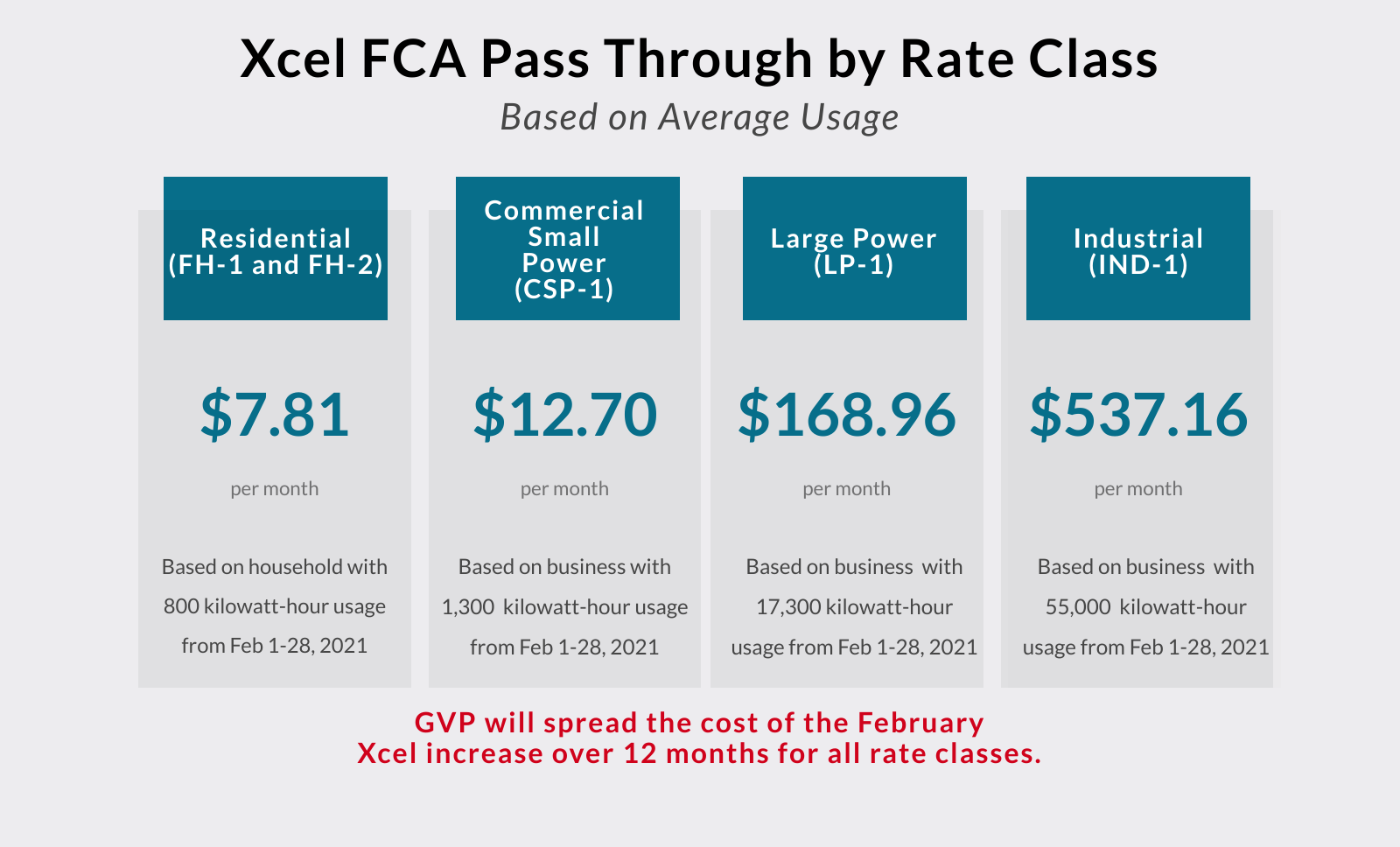

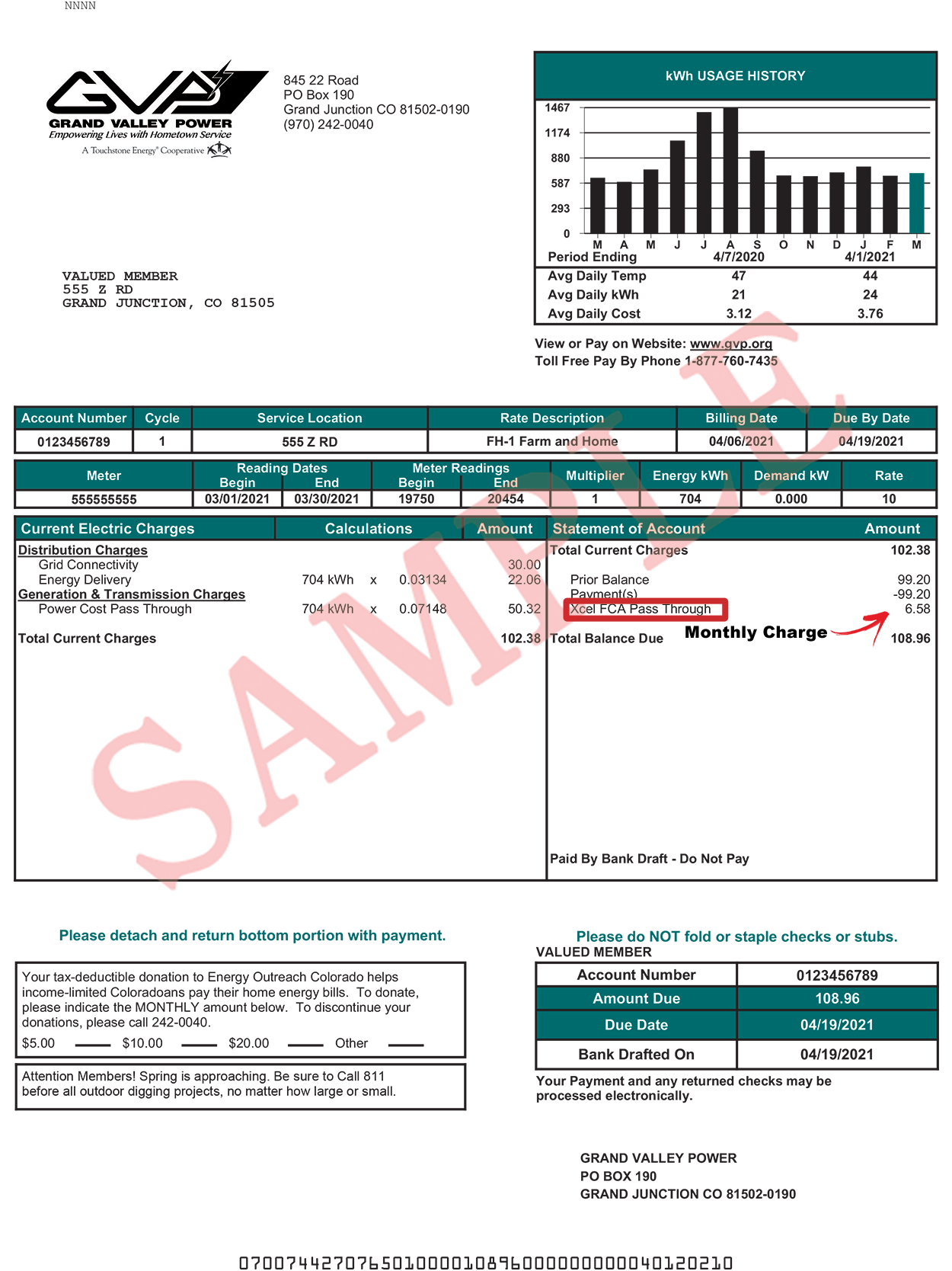

Our contract with Xcel is cost-based, a structure that ensures a reliable source of electricity that, in the past, has always been affordable. Under the contract, Xcel is able to recover its costs based upon formula rates and fuel cost adjustments. Grand Valley Power’s retail rate structure passes these Xcel power costs on to its consumers without markup. These costs are reflected on your bill with the Power Cost Pass Through line item. The fuel cost adjustment, or FCA, that Xcel tacked onto our wholesale power bill for February was so high that it would have been difficult for many consumers to pay all at once. To help our consumers, we will spread this cost over the next twelve months. Since it is a cost that is directly attributable to the Xcel February FCA, it will be shown on GVP bills as the Xcel FCA Pass Through.

For more on how we work with generation and transmission power providers, visit our power supply page.

During the storm that led to the spike in natural gas costs, and in its immediate aftermath, Xcel Energy, our wholesale power provider, gave us no indication that we would suffer any adverse impacts. Our power supply was never curtailed, and we never received any messages advising us to encourage our consumers to conserve energy usage because of tightening power or fuel supplies. In late February, news reports surfaced indicating that Xcel was facing a $650 million hit due to a spike in natural gas costs. Then, in early March, Xcel informed us that it would charge us for a share of these costs with an unprecedented Fuel Cost Adjustment of $2.37 million. Xcel is slamming GVP with a February wholesale power bill that is three times our normal monthly bill.

We have been digging for additional information and doing our best to challenge Xcel to reduce the cost impact for our consumers. We have already achieved some limited success, as Xcel initially indicated that our charge would be $2.6 million. After some of their preliminary numbers were questioned, this was reduced to $2.37 million. At the same time that we are looking into the Xcel charges, we are developing plans to help our consumers manage the added costs they will be facing. This planning takes a little time. Additional time is required to accurately implement detailed billing adjustments and develop comprehensive communications with our membership.

The short answer, from our perspective, is that Xcel should have been able to manage this better. Some Colorado energy providers avoided the devastating financial consequences that Xcel experienced during the February winter storm. They did this by paying attention to weather forecasts and securing natural gas purchases a few days earlier, before the market tightened and prices shot up. They did it with effective hedges and fuel storage, locking in the price for natural gas supplies far in advance. Some energy providers switched natural gas generating facilities to run on fuel oil, which doesn’t have the price volatility of natural gas. Some providers asked customers to cut back on consumption to reduce demand for power that was in short supply. Tri-State Generation and Transmission Cooperative supplies electricity to more than 40 distribution electric cooperatives in and around Colorado. These are some of the measures that it implemented. Its estimated added cost due to the winter storm event is less than $10 million. Their customers will see no impact on their bills.

In comparison to Tri-State’s $10 million hit for serving more than 40 distribution cooperatives, the FCA charges that Xcel passed on to the four distribution cooperatives that are their wholesale customers in Colorado exceed $15 million.

Xcel is patting itself on the back, saying its maneuvers saved customers $825 million. These claims ring hollow. Hedges and natural gas storage and purchases could have been managed much more effectively. Xcel claims it asked certain consumers to curtail usage, but no such request was passed on to GVP or its other wholesale customers. During the cold snap, Xcel gave us no indication that natural gas supplies were tight or that we would face any adverse consequences.

As a regulated utility Xcel has the right to ask consumers to pay its extra fuel costs. It initially planned to charge the average retail customer in Colorado $264 over the next two years to cover its Presidents Day weekend fuel bill. But facing pressure from Governor Jared Polis, Xcel voluntarily agreed not to use fuel cost riders for its retail customers. Instead, it will participate in proceedings at the Colorado Public Utilities Commission (CPUC)where it will ask for approval to pass these costs through to retail customers.

GVP’s contract with Xcel does not fall under the jurisdiction of the CPUC. Instead, it is regulated by the Federal Energy Regulatory Commission (FERC). We asked Xcel to offer wholesale customers the same accommodation extended to its retail customers – asking the regulatory agency to approve costs passed on to customers – and it has declined to do so.

Grand Valley Power’s Power Purchase Agreement with Public Service Company of Colorado (a subsidiary of Xcel Energy) is regulated by the Federal Energy Regulatory Commission (FERC) and is subject to that agency’s jurisdiction. Grand Valley Power’s management team has joined with representatives of other Xcel wholesale customers to investigate and analyze the circumstances giving rise to this February FCA fiasco. We are doing everything in our power to reduce the financial impact that will be felt by all Grand Valley Power members. It may take time, but any success we achieve in reducing these charges will be passed along to our consumers.

Going forward, everyone on the Grand Valley Power team understands that our members expect and deserve a reliable, affordable source of electric energy. If we can’t get that out of our relationship with Xcel, we will look seriously at other alternatives.

In mid-February, Winter Storm Uri blanketed the central United States with record cold temperatures that challenged the electric grid. The storm triggered a tightening of the market for natural gas, a fuel source used to heat homes and generate electricity. This caused the price of natural gas to skyrocket, and several generation and transmission (G&T) utilities ended up paying the price to meet energy demands.

Grand Valley Power’s wholesale energy provider, Xcel Energy, is one of the G&T providers that ended up paying these high fuel prices to operate their facilities. Xcel is passing along these charges to wholesale providers, like GVP, and is now slamming the cooperative with an additional $2.37 million Fuel Cost Adjustment (FCA).

This video is dedicated to answering your questions regarding the impact of these price spikes and what it means for co-op members.